I have a confession to make in being on board "team transitory", or the belief that the recent (global) increase in inflation is due to largely temporary factors. As these factors fade, we are set to resume the previous economic environment of relatively benign inflation. On the demand side, these temporary factors include increased demand for consumer goods as people stayed more at home due to the pandemic. Economic stimulus provided by rich countries to their citizens further fueled this demand. On the supply side, disruptions in goods production, transportation and retail also arose due to the pandemic. More demand + less supply = inflation.

Meanwhile, critics of the idea that high inflation is transitory argue that there have been changes in the world economy which contradict the transitory idea such as the emergence of a major war on the European continent--the first since the end of WWII--causing strains in the availability of commodities like energy and grains. Also, prices of not only goods but also services should be factored in since the latter have increased, too. In other words, inflation is becoming entrenched and is not a temporary phenomenon.

Little-noticed in this debate is the International Monetary Fund (IMF) weighing in recently with its most recent take on the matter. According to the IMF, there were longstanding economic phenomena well underway before the pandemic that point to lower inflation whose momentum will be very difficult to overcome. These include:

- Total factor productivity falling significantly, which lowers economic output;

- Demographic changes resulting in fewer persons of working age (and more retirees), which also reduces economic output;

- For developed countries at least, inflows of capital from developing countries in search of more secure returns.

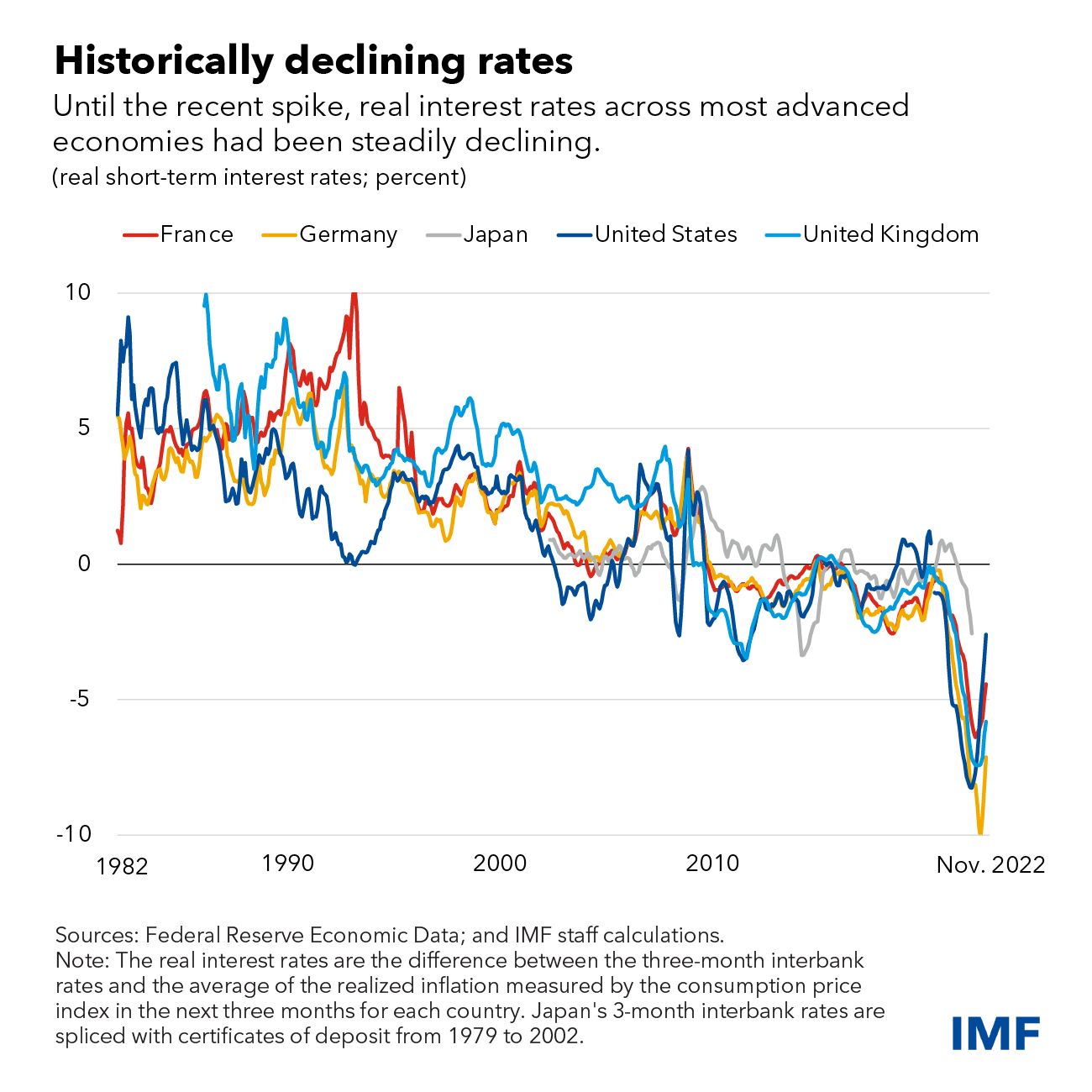

While there too are factors pushing up rates such as running sizable national budget deficits (that have to be funded by offering higher returns to lenders), the overall picture in the developed world is of declining rates, on the balance. Here is another IMF chart:

Absent some unforeseen modern-day productivity boom or baby boom, you would generally expect rates to trend downward in the developed countries. As they become older--like China whose population is already falling outright--developing countries should follow the same path. Add in other factors the IMF found also lead to lower rates such as elevated and rising inequality--rich people tend to save more and spend less--as well as the decreasing labor share of income--leaving workers with less disposable income--and the picture for rate moderation is compelling.

On this matter at least, I think this IMF research is spot on, with some caveats. We are not quite sure when current (transitory) inflation pressures let up precisely, but they will eventually be swamped by stronger factors favoring lower rates. Aging and diminished productivity along with a handful of other factors will lead us back to a low rate economic environment once more. You have to be brave to bet otherwise.