Of note in this respect are the Chinese. The stereotype of Chinese industrialists enticing corrupt regimes all over the continent with easy money in exchange for mineral access is a story told over and over. Stung by this criticism, the PRC decided to change tack in characterizing their activities as developmental win-win situations: In exchange for being granted access to mineral resources, the Chinese would help improve the infrastructure of the countries they operated in to accommodate the influx of wealth brought by extractive industries. That is, improved ports, roads, power stations and so forth would better facilitate trade and development for all concerned. Well, that was supposed to be the story of the Belt and Road initiative:

China's engagement in Africa, a focus of the Belt and Road Initiative (BRI), grew rapidly in the two decades before the COVID-19 pandemic. Chinese companies built ports, hydropower plants and railways across the continent, financed mainly through sovereign loans. Annual lending commitments peaked at $28.4 billion in 2016, according to the Global China Initiative at Boston University.

But many projects proved unprofitable. As some governments struggled to repay loans, China cut lending. COVID-19 then pushed it to turn inward, and Chinese construction projects in Africa fell.

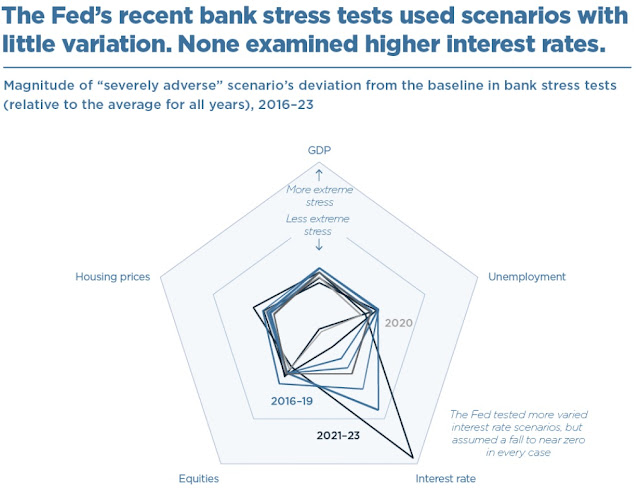

The chart above indicates what's happened to the much-touted Belt and Road Initiative. Of course lending without conducting substantive due diligence to regimes with questionable governance records was not conducive to being paid back on time! Post-COVID and all these post-non-performing loans, the Chinese are back in Africa. However, the pretense of mutual benefit is largely gone, replaced by a massive focus on extracting more than Westerners can. Yes, it's neocolonialism at its crudest, but it is what it is:

Worse still, lots of Chinese goods are flooding these African countries at low prices, creating substantive trade deficits with China all over the continent. In trade terms, it's likely a case of "dumping":

With one of Africa's largest trade deficits to China, Kenya has been pushing to increase access to the world's second-largest consumer market, recently gaining it for avocados and seafood. But cumbersome health and hygiene regulations mean Chinese consumers remain out of reach for many producers...But Chinese manufactured goods kept coming. That's not sustainable, said Francis Mangeni, an advisor at the Secretariat of the African Continental Free Trade Area. Unless African nations can add value to their exports through increased processing and manufacturing, he said, "we are just exporting raw minerals to fuel their economy."

The story never changes of foreigners exploiting natural resources and

then profiting by selling higher value-added goods in these African

nations, thereby stifling indigenous development that would occur by

garnering capabilities to produce more sophisticated products. The Chinese can keep repeating holier-than-thou rhetoric about not being like those Western imperialists exploiting Africa with naked greed, but it's what they do and not what they say that ultimately counts.