♠ Posted by Emmanuel in Casino Capitalism,Europe

at 6/07/2012 11:24:00 AM

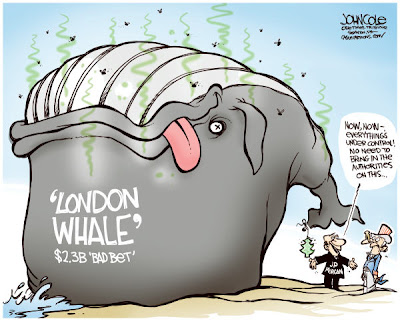

I've long supported the claim that London, not New York, is the financial capital of the world [1, 2]. I guess it's a backhanded compliment to London's claim to be the world's financial capital that earthshaking events for US financial concerns more often than not emanate from there instead of New York. Think of AIG's disastrous credit default swaps (CDS) being written in London. Or, to be current, JP Morgan Chase's London Whale messing around with CDS indices.However, this trail of casino capitalism lacks another element to the story: So London may in fact be laxer and thus more attractive than New York when it comes to freewheeling financial frivolity, but where exactly do these budding masters of the universe come from? To be sure, the "rogue trader" can be from anywhere: Think of "pioneers" such as Japan's Yasuo Hamanaka, England's Nick Leeson and so on. As of late, though, there has been a distinctly Francophone flavour to these questionable characters, most recently Bruno Iksil, the London Whale himself.

Christopher Dickey of Newsweek does us a favour by describing how France has been a hotbed for graduates in the dark arts of financial engineering. The French have always had a penchant for mathematics, thus it's no surprise that recent years have witnessed its application in fields where the profit motive is strong. That said, the country itself has (thankfully) cast a weary eye on laissez-faire banking practices and has limited the wiggle room for budding casino capitalists. So, while various French universities produce financial engineering graduates dreaming of fame and fortune, their skills are much more in demand in what Bonaparte once called a nation of shopkeepers:

London is a magnet for France’s young financial professionals. They often prefer to work in what they call “Anglo-Saxon” environments (New York is another). Job openings are more abundant, salaries and bonuses aren’t so heavily taxed, and the culture admires success rather than envies it, as often happens in France. And there’s one advantage New York can’t match: in London, French transplants are blessed with easy weekend commuting via the Eurostar, which now runs from the heart of Paris to the heart of London in two and a half hours. The young City of London veteran, an El Karoui [quant goddess] disciple who prefers not to have his name in print, recalls his years at a major British bank where his team eventually numbered roughly 40 members, at least 75 percent of whom were either French or had a French educational background. Among the elite schools they attended: Paris VI with El Karoui, the ESSEC international business school, and the Université de Paris Dauphine—three of the many French temples of financial learning where formal mathematics is emphasized.Though I suspect the JP Morgan Chase incident was unique in being a known entity with formal backing from the heads in New York, there may be a grain of truth to those far more junior than the London Whale being made scapegoats characterized as villainous "rogue traders." It is not entirely obvious why large positions without sanction can so readily be amassed in the absence of an infrastructure designed to accommodate such large positions:

The traders, the structure guys, and the quants have all seen the numbers sort themselves out before, and they may be tempted to imagine they’ll see it happen again this time. The outside world hears only about the derivatives that go wrong, while careers are built on the ones that go right. That’s how things have gone in the past, anyway. At JPMorgan Chase, hundreds of billions of dollars were in play, and Iksil was part of a unit that had earned $5 billion in the last three years. Given the extent to which teams are involved in the work of refining and improving the products, the idea that a “rogue trader” can make billion-dollar bets all on his own is, to say the least, improbable. It’s worth noticing that other heads besides Iksil’s are rolling already at JPMorgan—and they’re not French.