|

| SoftBank-ARM was a fine idea at the time; now it's a brilliant mistake. |

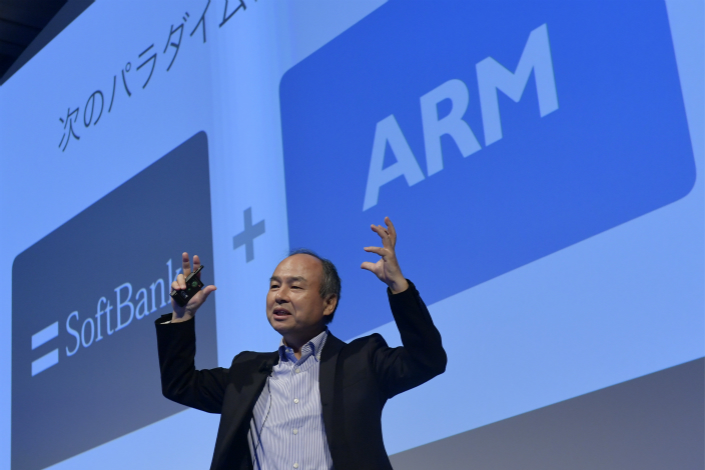

Hard as it may be to believe given how downtrodden it is now, Japan's SoftBank was once regarded as a formidable presence on the global technology stage. Sure, it always carried a fairly high level of debt, but its principal Masayoshi Son was regarded as an Asian tech visionary in the mold of a Bill Gates or Steve Jobs. Just as Japan, Inc. gorged on buying US properties in the 1980s, SoftBank gobbled global tech shares in the 2000s, culminating in the creation of Vision Fund for venture capital. Launched in 2017, the Vision Fund's losses have dragged down Softbank as of late. Casting such a wide net, some purchases were bound to be successes (like Alibaba) while others were duds (like WeWork). Unfortunately, it seems SoftBank has had more of the latter than the former.

Arguably SoftBank's crowning purchase was the UK's ARM Holdings for $32 billion in 2016. Based in the college town of Cambridge, ARM licenses leading-edge microchip designs used in almost all of today's smartphones. Such licensing revenue is huge. However, ARM has been shopped around for a number of years now to help resuscitate its parent company's finances.

From an international political economy standpoint, what is interesting is that ARM has chosen not to make its initial public offering (semantically a re-offering) on the London Stock Exchange where it was listed prior to SoftBank's 2016 purchase. Spurning national pride, it has chosen to list in the United States. So much for UK government entreaties to lure ARM back home, at least financially:

“After engagement with the British Government and the [Financial Conduct Authority] over several months, SoftBank and Arm have determined that pursuing a U.S.-only listing of Arm in 2023 is the best path forward for the company and its stakeholders,” Arm CEO Rene Haas said in a statement. Arm did not completely rule out the possibility of listing in London in the future, saying it was “proud of its British heritage” and may consider a subsequent listing in the U.K. at a later date. It provided no further details.

The decision comes despite intensive lobbying efforts by the British government to persuade the chip designer to list its shares in the U.K. capital. With 6,000 staff globally and 3,000 based in the U.K., Cambridge-based Arm is widely regarded as the jewel in the crown of the British tech industry.

The company is a major force in the semiconductor market, licensing its microchip designs to some of the world’s largest consumer tech manufacturers. Around 95% of smartphones globally, including the Apple iPhone, contain Arm-based processors.

London has relaxed its listings rules in an effort to attract leading global tech companies to go public in the U.K. It faces barriers, with venture capitalists complaining of a lack of understanding of often loss-making tech ventures.

Although the soon-to-be defunct Softbank-ARM linkup has many interesting angles to it, there are two of particular note here: The fall of Masayoshi Son who though the world was his (tech) oyster is one. Another is the London Stock Exchange's inability to attract tech IPOs. With many of its listings consisting of traditional industries like energy and finance, the UK reputation as an investment destination for technology could literally have received a shot in the ARM. But alas, it has just been announced that ARM will soon list Stateside a few weeks after the UK was spurned:

SoftBank Group Corp's chip maker Arm Ltd has filed with regulators confidentially for a U.S. stock market listing, Arm said on Saturday, setting the stage for this year's largest initial public offering. The IPO registration shows that Softbank is pressing ahead with the blockbuster offering despite adverse market conditions, after saying in March that it planned to list Arm in the U.S. stock market.

U.S. IPOs, excluding listings for special purpose acquisition companies, are down about 22% to a total of just $2.35 billion year-to-date, according to Dealogic, as stock market volatility and economic uncertainty put many IPO hopefuls off.

Arm plans to sell its shares on Nasdaq later this year, seeking to raise between $8 billion and $10 billion, people familiar with the matter said. In a statement, which confirmed an earlier Reuters report on the planned IPO, Arm said the size and price range for the offering has not yet been determined.

The Matthew Effect is alive and well in tech, I guess. Given the UK's self-inflicted harm over Brexit, it is not unexpected that one of its national champions would prefer to list in the capital- and tech-intensive United States which already has many of tech's top firms. Maybe the UK will get a consolation prize of a secondary listing a few years down the road, but for now, it has come up empty.

5/19 UPDATE: The ARM sale probably couldn't come sooner as the SoftBank Vision fund has just announced a scarcely believable $39B loss.